About Me

I'm a software-oriented data scientist, with a degree in Data Science & Finance looking to challenge myself in dynamic work environments.

Over the last 4 years, I've had the opportunity to work and perform research in 3 countries across 4 different industries.

In and out of University, I'm focused on developing my skills as a young Data Scientist, most recently through work in developing deployment-ready data products.

Here's what I've been up to

Here's where I've been

New York University

Adjunct Research Associate of Data Science, April 2019 - Current

New York, NY

Actively pursuing Dynamic Topic Models to help diagnose areas of the US worst impacted by the COVID-19 Pandemic. Developed a reusable Apache Spark Big-Data Pipeline to stream, preprocess, and analyze ~4.5 million tweets daily, utilizing custom LDA models to detect topics actively over time. Extended popular NLP Libraries (e.g. Scikit-Learn, NLTK), building custom parallel tokenization and vectorization packages to help analyze a dataset of over 300 million+ tweets.

PwC Advisory

Data & Analytics Intern, Jun 2019 - Aug 2019

New York, NY

I was tasked with the end-to-end development of python-based financial transaction screening automations and transaction data quality assessment tools.

As part of the internship, I Implemented an automated SQL DB quality evaluation process utilizing a Python ORM (SQLAlchemy) to determine client DB statistical properties.

In my short time, I was able to spearhead discussions with key account stakeholders regarding NLP and ML applications in PwC's Financial Crimes Unit.

Morgan Stanley

Risk Management Analyst, Nov 2018 - May 2019

New York, NY

To help support myself financially, I took up a part-time role at Morgan Stanley (22hrs/week) while enrolled full time in University.

I split my time between two teams, Vendor Management where I performed vendor database assessments to identify internall cross-unit discrepancies,

and Anti-Money Laundering where I performed associate-level negative news screenings, investigative functions, and built excel-based automations.

BDO Consulting

Corporate Finance Intern, Jun 2018 - Aug 2018

Tel-Aviv, Israel

BDO was the culmination of my studies in Finance. I performed comparables analysis, financial modeling, and valuations for leading Israeli tech startups and companies in the biotech, defense, and agriculture industries.

With my experience working in China, I produced a Purchase Price Allocation study for an Asian contract development biotech merger.

As a side-project, I developed an R-based program for comparable valuations built on Yahoo Finance and Bloomberg APIs.

TavTech

Coding Fellow, Dec 2017 - Jan 2018

Tel-Aviv, Israel

The TavTech fellowship was my first real forray into the worlds of Big Data and AI.

In addition to learning the foundations of Big Data tools (e.g. Apache Spark, Hadoop, HDFS), the fellowship culminated in a 48-hour hackathon, where I helped to develop

an application using machine vision to assist individuals with learning-disabilities.

GE Applicances: FirstBuild

Project Management Intern, Apr 2017 - Jul 2017

Shanghai, CN

My first internship as an undergrad in Shanghai, FirstBuild was a phenomenal opportunity to understand start-up culture as it exists in China.

As an intern, I coordinated weekly Thinktank sessions with FirstBuild's CEO and upper-level staff concerning minimum viable products

(FirstBuild functioned as a "Prototype Incubator"). I also standardized company brand materials across their many divisions.

How I keep busy

Urban Data Science Capstone

NLP Undergraduate Capstone

We deploy an end-to-end data processing pipeline and implement a Sequential Latent Dirichlet Allocation model to track the daily growth and changes in topic composition of 8 million tweets over the period March 31st to April 13th. We successfully identify 12 diverse topics which exhibit strong macro-trends over time while experiencing micro topic variations, covering domains such as healthcare, politics, community, and economics.

HealthHub

Flask Based Full-Stack Application

HealthHub represents a semester-long team project for CSCI-410 Software Engineering, where I primarily played the role of a back-end engineer, structuring the database (i.e. MAMP)

as well as developing the MVC framework (Model: SQLAlchemy, View: Flask-Blueprints, Controller: Flask Instances), based on the popular Flask web app micro-framework.

The application includes an appointment scheduling system, a social forum, a file storage system, record-keeping, and an automated asynchronous notification system built on celery & redis.

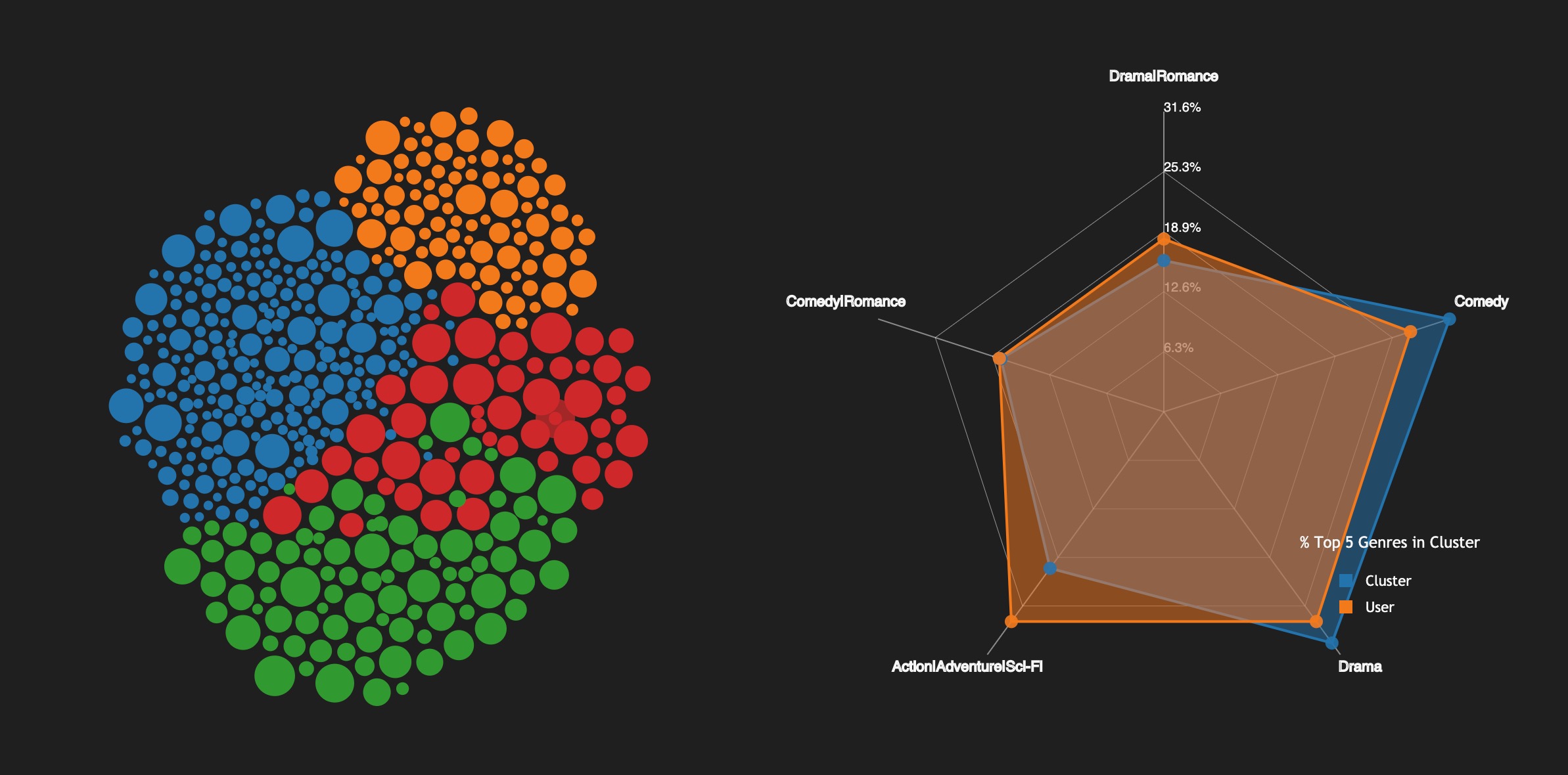

MovieLens Visualization

Data Pre-Processing and Information Visualization

The MovieLens Dataset has been the subject of various kaggle competitions and is often used for educational purposes.

In this project, a friend and I decided to put our data visualization skills to the test (e.g. Python, D3.js, & HTML/CSS) and design visualizations that would

convey aspects of the dataset such as the historical relations between film revenues, release dates, and ranks, as well as provide

for a time-series snapshot of the industry (e.g. top grossing studios vs. films). We also used Singular Value Decomposition and

k-means clustering for classifying user tastes & preferences. Check out the Demo Link!

Predictive Analytics: Spotify Brand Mentions

Graduate Big Data Science Course Semester Project

In this project, we analyzed the daily occurrences of luxury brand mentions in Spotify's most

streamed songs and modeled the relationship between a brand's occurrences in popular songs with the

brand's popularity, as measured by Google Trends. We utilized Stanford Java Core-NLP for lemma generation,

LDA for topic generation, and ARIMA (e.g. a statistical model for measuring volatility), to predict brand popularity.

Technologies used include: Java, Core-NLP, Apache-Spark, High-performance Computing, & Python for web scrapping and data cleansing.

Cryptocurrency Asset Classification

Machine Learning Final Project

This project grew out of raw curiosity for the cryptocurrency market at the end of

2017, when the cyrpto market had peaked, collapsing in February of 2018, when it exhibited risk-asset like tendencies. I was curious as to what asset classes crypto most resembled.

To get there, I implemented advanced statistical models (e.g. GARCH and ARIMA) to gather features that measured volatility of assets, and paired these features with volume and return data

to build SVMs for predicting asset returns, and ANNs for classifying Assets. I concluded that Bitcoin behavior most resembled traditional currencies over commodities (e.g. gold) with inconclusive results in regards to SVMs.

What I'm good at

Data

Science

Science

Experienced in Natural Language Processing, Machine Learning (e.g. Regression, SVMs, ANNs etc.), Statistical Modeling (e.g. ARIMA, GARCH), & in building data pipelines for applications.

Software

Engineering

Engineering

Background in computer science with solid foundations in software lifecycles, object-oriented programming, data structures & algorithms and web app development frameworks (e.g. Python Flask, Javascript Dev.).

Information

Visualization

Visualization

Comprehensive experience with Javascript, Python, HTML/CSS toolkits for pre-processing and visualizing large datasets. Academic understanding of data-vis and vis-psychology.

Business

& Finance

& Finance

Bachelors in Finance, with experience working in Financial Intitutions and Financial Services. Full-understanding of foundational quant-finance models for Data Science.

Hover Over Categories

Contact Me

US Phone: +1 (732) 742-8094

CN Phone: +86 (186) 1671-2812

Email: alex.bogdanowicz@nyu.edu

CN Phone: +86 (186) 1671-2812

Email: alex.bogdanowicz@nyu.edu